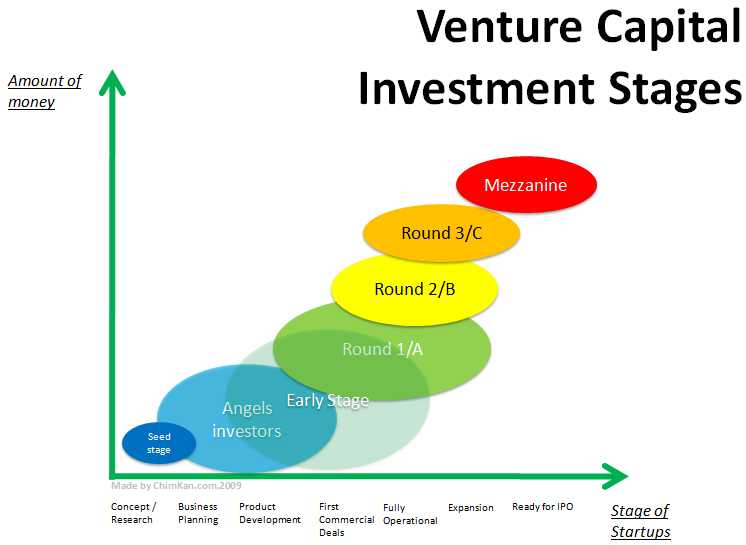

Startups go through a series of funding from venture capital firms. Capital is raised in multiple rounds of financing as the valuation of a company may increase when the startup demonstrates:

- Increased probability of success

- Proof of concept

- Growth in customer base, etc.

In each round of financing, valuation is done independently. Investors who invest in early rounds prefer to invest in subsequent rounds too to maintain their share in the company over time.

Startupfreak has also curated the top 10 Global institutions who give equity free money – These worldwide funds help you to explore new global markets along with some free money you get as a bonus! check out 10 Programs around the world giving equity free money

What is Seed and Angel Funding

If you are in an early stage/Idea Stage in your Business Plan and have utilized your saving and built a product which is already selling.., you may expect some Angel Investors to be really interested in your startup, or if you have an excellent idea and a really good team then investors may be willing to help you build the product too. Read more About Angel Investors

What is Series A Round of Funding

Series A round of financing is the first round of financing that a startup receives from a venture capital firm i.e. the first time when company ownership is offered to external investors. This is generally done by allotting preferred stock.

Valuation of the startup in this round is done on the basis of:

- proof of concept

- progress made with seed capital

- quality of the executive team

- market size

- risk involved

The goal of Series A round of financing is:

- To cover up salaries of people involved

- Additional market research

- Finalization of product/service to be introduced into the market

Series A round of financing is generally done when a company is generating some revenue, though it might not be net profit. The risk involved is at the highest in this round of funding.

What is Series B Round of Funding

At this stage, the product/ service is already being sold in the market. Series B round of funding is required by the company to scale up, to face competitors and have a market share. The goal of this round of funding is not only to break even but to also have the net profit. At this stage, investment risk is lower and the amount of funding is more than Series A round of funding.

Valuation of the company is done on basis of:

- Performance of the company in comparison to the industry

- Revenue forecasts

- Assets like Intellectual Property, etc.

What is Series C Round of Funding

A venture capital firm goes for this round of funding when the company has proved its mettle and is a success in the market. The company goes for Series C round of funding when it looks for greater market share, acquisitions, or to develop more products and services. Series C round of funding can also take place to prepare the company for an acquisition. It is the last stage in a company’s growth cycle before an Initial Public offer (IPO). Valuation of the company at this juncture is done on the basis of hard data points. This round of funding is more of an exit strategy of the venture capital firm.

Startup Freak Community for entrepreneurs and small businesses

Startup Freak Community for entrepreneurs and small businesses

One comment

Pingback: Investment Termsheet Elements explained – 10 Things to watch out on your Termsheet | Startup Freak